Explainer — China Tariff Tipping Point: The Bullwhip Effect

Even if tariffs vanish tomorrow, supply chaos and price spikes will linger. America’s supply chain shock has only begun. Read the full Analysis and Scenarios Report

The United States’ new wave of tariffs on Chinese imports has triggered a profound supply chain shock that will reverberate through global markets for years.

Even if these tariffs were repealed tomorrow, the damage is done: supply chains have seized up, manufacturers are frozen, and a bullwhip effect has already begun.

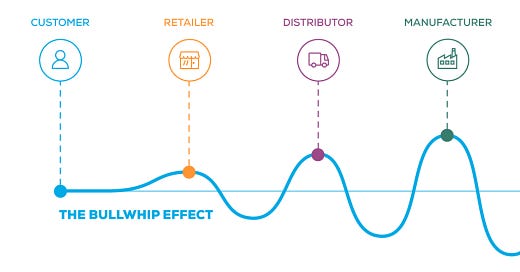

The bullwhip effect is a supply chain phenomenon where small fluctuations result in out-sized, exponential delays in delivery and gluts in inventory that result in delayed a deluge of product.

The American tariffs on products from China now threaten everything from consumer prices to corporate investment.

This report dissects the economic and geopolitical fallout, drawing on current data, historical parallels, and the unique mathematics of supply chain chaos. I offer targeted recommendations for market professionals, analysts, small businesses, and consumers to navigate the turbulence ahead.

Table of Contents

Introduction: The New Reality of Trade Disruption

Anatomy of the Bullwhip Effect in Trade Wars

The 2020-2022 Semiconductor Shortage: A Real-World Bullwhip

The Role of Trade Policy

Exponential and Fractal Patterns

Why Current Tariffs Threaten a Repeat (or Worse)

The Supply Chain Freeze: What Happens When Trade Stops

Inflation and Price Volatility: The Consumer Impact

The Myth of Rapid Reshoring

Economic and Geopolitical Risks

Policy Recommendations for Navigating the Tipping Point

Probable Scenarios for Supply Chains and Markets

Scenario 1: Prolonged Tariff Stalemate and Supply Chain Freeze

Scenario 2: Partial Tariff Rollback with Gradual Recovery

Scenario 3: Comprehensive Trade Agreement and Realignment

Targeted Recommendations for Key Stakeholders

Market- and Corporate-Investment Professionals

Geopolitical and Economic Analysts

Small Businesses Sourcing from China

Consumers of China-Sourced Products

Conclusion: The Long Road to Recovery

APPENDIX — The Math of The Bullwhip Effect

Exponential Demand Amplification

Fractal Demand Patterns

Post-restart ordering creates self-similar distortions across supply chain tiers:

Network Effects

Executive Summary

The United States’ new wave of tariffs on Chinese imports has triggered a profound supply chain shock that will reverberate through global markets for years.

Even if these tariffs were repealed tomorrow, the damage is done: supply chains have seized up, manufacturers are frozen, and a bullwhip effect has already begun.

The bullwhip effect is a supply chain phenomenon where small fluctuations result in out-sized, exponential delays in delivery and gluts in inventory that result in delayed a deluge of product.

The American tariffs on products from China now threaten everything from consumer prices to corporate investment.

This report dissects the economic and geopolitical fallout, drawing on current data, historical parallels, and the unique mathematics of supply chain chaos. We offer targeted recommendations for market professionals, analysts, small businesses, and consumers to navigate the turbulence ahead.

Keep reading with a 7-day free trial

Subscribe to The Digital Luddite to keep reading this post and get 7 days of free access to the full post archives.